when can life insurance be denied

Kantor says the most common reason insurers give for denying life benefits is if you fail to disclose information needed to accurately measure the risk of a policy payout. Your life insurance application could potentially be rejected because of your mental illness.

Top 21 Reasons Denied Life Insurance And Tips On How To Avoid Them

Heres what you can do if your life insurance application has been rejected.

. The beneficiary attorneys at Boonswang Law have seen it all and can help you fight back appeal the life insurance claim denial and get paid if your coronavirus claim was denied. You could be denied traditional life insurance for several reasons. Life insurance underwriting is a process your insurer undertakes to determine your eligibility and rates.

It is important to select an insurance carrier with a lenient policy towards build requirements which is your height to weight ratio. Yes your claim for life insurance can be denied for different reasons. If you have had your life insurance claim denied in a phone call you have every right to contact your life insurance.

We have helped many beneficiaries across the nation. For over 35 Years SelectQuote Has Helped People Find The Right Insurance For Their Needs. The most common reason is that you made an inappropriate claim.

Whether your denied claim for death benefits can be paid eventually will depend upon the factors explained in this article. This amount is usually between 25000 and 30000 depending on your age. However because every life insurance company will have its own rules regarding weight limits it is possible to.

Trusted by customers for over 50 years. They tend to be less expensive than whole life insurance policies saving you money in the long run. Yes a life insurance company may deny you coverage if you are overweight.

By knowing what underwriters take into consideration you can prepare put. Insurers deny the death benefit on life insurance claims for reasons of policy delinquency material misrepresentation. In some random cases a beneficiarys claim may be denied via a phone call.

If you intentionally leave out anything the insurance company needs to know on your application or during the phone interview the. Contest the decision with the insurer directly most. Ad Term and Whole Life Insurance You Can Rely On.

Can Life Insurance Be Denied If You Have A Mental Illness. Life Insurance Coverage In 3 Easy Steps. SelectQuote Rated 1 Term Life Sales Agency.

The medications listed below do not mean a life insurance company will definitely decline to offer you coverage. Life insurers may contest and deny a claim if death occurred due to suicide within the two-year constability period. But many of these medications treat a variety of medical.

Trusted by customers for over 50 years. Whether its an accident or a stolen car. Figure Out Why You Were Denied Life Insurance.

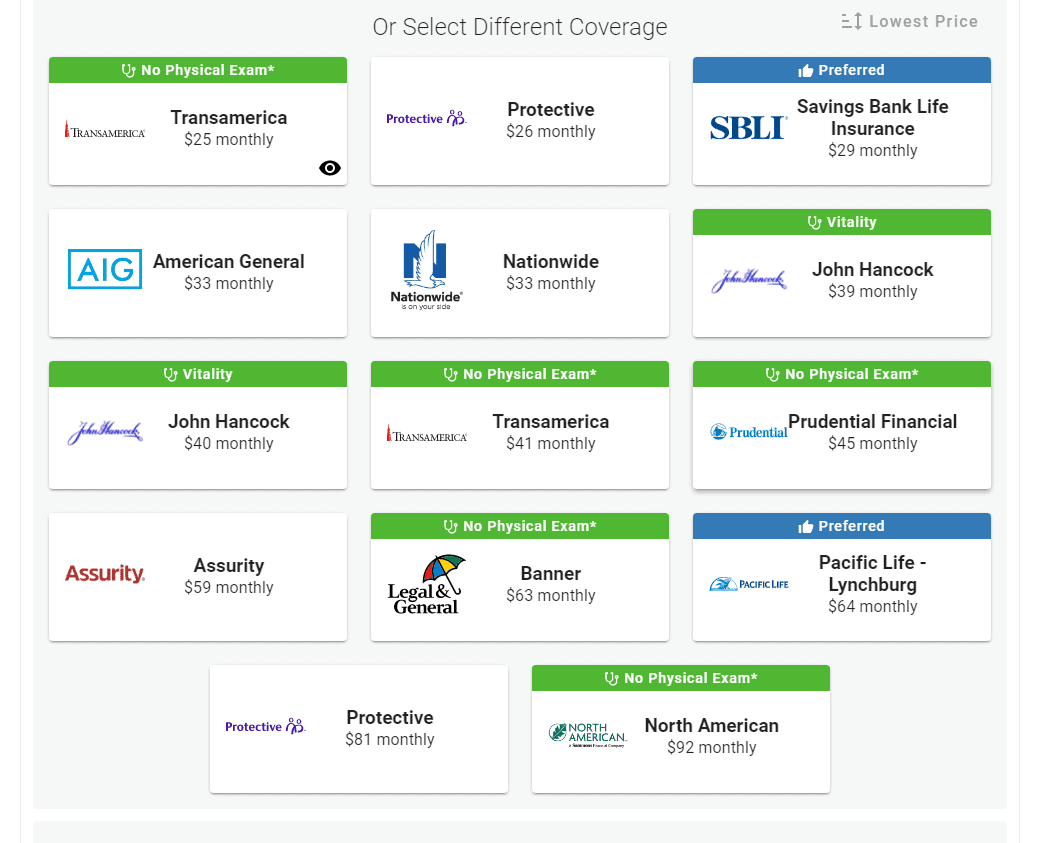

Ad Apply online today. Help protect your loved ones with valuable term coverage up to 150000. Ad Compare the Best Life Insurance Providers.

Along with the suicide. Trusteed For Over 100 Years. Ad Shop The Best Rates From National Providers.

Unfortunately insurance companies can and do deny policyholders claims on occasion often for legitimate reasons but sometimes not. If you feel you have a solid case and want to appeal your denied life insurance claim you can. Ad Youre eligible to apply for exclusive term life insurance from New York Life.

This could mean providing incorrect. Many insurers that offer guaranteed issue life insurance policies have a limit on the death benefit. Reasons why life insurance claims are denied.

Reviews Trusted by 45000000. Ad Apply online today. Universal life insurance policies are permanent.

21 Death due to suicide. Appeal the rejection. The assisted suicide debate continues but for now suicide within the first two years of taking out a policy is usually cause for your life insurance claim to be denied.

From 15 A Month. Discover The Answers You Need Here. This can differ depending.

In most cases the insurance company will deny a claim if the death was not accidental or if the policyholder did not follow the proper procedures for filing a claim. Lying or withholding information.

I Was Just Denied Life Insurance Because I Was Sexually Assaulted Updated By Julia A Pulver Rn Bsn Ccm Medium

What Are The Reasons Life Insurance Won T Pay Out Life Settlement Advisors

Appealing An Erisa Life Insurance Denial Monast Law Office

Top 5 Reasons To Be Denied A Life Insurance Claim And What To Do

Triple I Blog Are Life Insurers Denying Benefits For Deaths Br Related To Covid 19

Qualifying For Life Insurance With Lupus Nephritis Is It Possible Justburyme

Life Insurance Law Firm Life Insurance Denial Lawyer Missouri

Reasons You Might Have Been Denied Life Insurance Sbli

What To Do If You Have Been Denied Life Insurance Navy Mutual

How Long Does Life Insurance Take To Pay Out 2022

Common Reasons Why Insurers Deny Life Insurance Claims Kamm Insurance Group

/images/2020/06/08/concerned-woman-using-laptop.jpeg)

Denied Life Insurance 8 Possible Reasons Why And What To Do Next Financebuzz

Life Insurance Claim Denied What Are My Legal Options

10 Reasons For Life Insurance Claim Denials Or Delays Life Insurance Lawyer

What To Do If Your Life Insurance Company Denies A Claim Bankrate

The Grace Period For Life Insurance Policies Boonswang Law

What To Do After A Life Insurance Claim Is Denied Bartolic Law Life Insurance Claim Denial Chicago

Top 7 Reasons Your Life Insurance Claim Was Denied Hml Law

What To Do If You Re Denied Life Insurance Ramseysolutions Com